‘Customer is always the King’ and Smart Customization in the Retail Banking sector is a result of the creation of both profitable and sustainable mass customization offerings of retail banking products. Identification of the interrelationships between service quality, customer satisfaction and customer loyalty in the retail banking sector could be used to evaluate the characteristics of banking service quality as perceived by customers.

Smart customization is profitable because customers are happy to pay more for the customization experience as well as for the outcome of customization in any sector and it is equally sustainable because products are built to order and assembled close to the customer, limiting inventory carrying costs and reducing transportation costs. Among the service industry stakeholders, the banking sector is perhaps the largest one that caters to the needs of people belonging to all sections of society. Moreover, perceived service quality tends to play a significant role in the interaction between customers and the service providers. Amid intense competition and the dynamic business environment, surviving in the market has become a key challenge for many service organizations including Retail Banks. Service Quality, Efficiency and Delivery had become the key tools for surviving and gaining competitive advantage in retail banking industry, since its offering comprised mainly of intangible elements. The retail bank’s perception of service quality may be quite different from what retail customers perceive as service quality. It is therefore, important for any retail bank to understand customer’s perception of service quality in the light of great competition, numerous customer complaints and movement of customers from one retail bank to another.

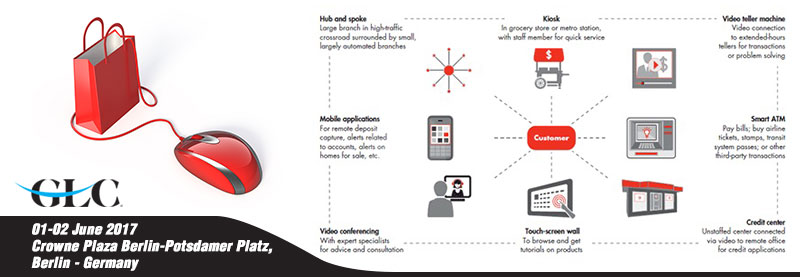

Achieving Service Quality, Efficiency & Delivery in Retail Banking via Smart Customization will be a key area that will be explored in detail at the 5th Annual Retail Banking Forum tiled as ‘#DIGITAIL’ scheduled to be held from 1st to 2nd June 2017 at Crowne Plaza Berlin, Germany. The event will be a great platform that enables retail bankers of many regions around the world to learn the new ways of how to stimulate bonding through trust between them and customers, which affects the latter’s perception of any retail banking brand.

Learn more about the topic at: