Payments industry in entire Europe is describing the forthcoming Payment Services Directive (PSD2) as a game changing directive. It important to know that this PSD 2 revised regulation is scheduled for implementation across the European Union (EU) member states from 13th January 2018. According to experts in the payments industry, PSD2 is certainly transformative. It does not only end banks’ monopoly on their customers’ account information and payment services, but it also forms part of a rapidly evolving financial environment in which banks will struggle to survive if they do not embrace the new payments regime.

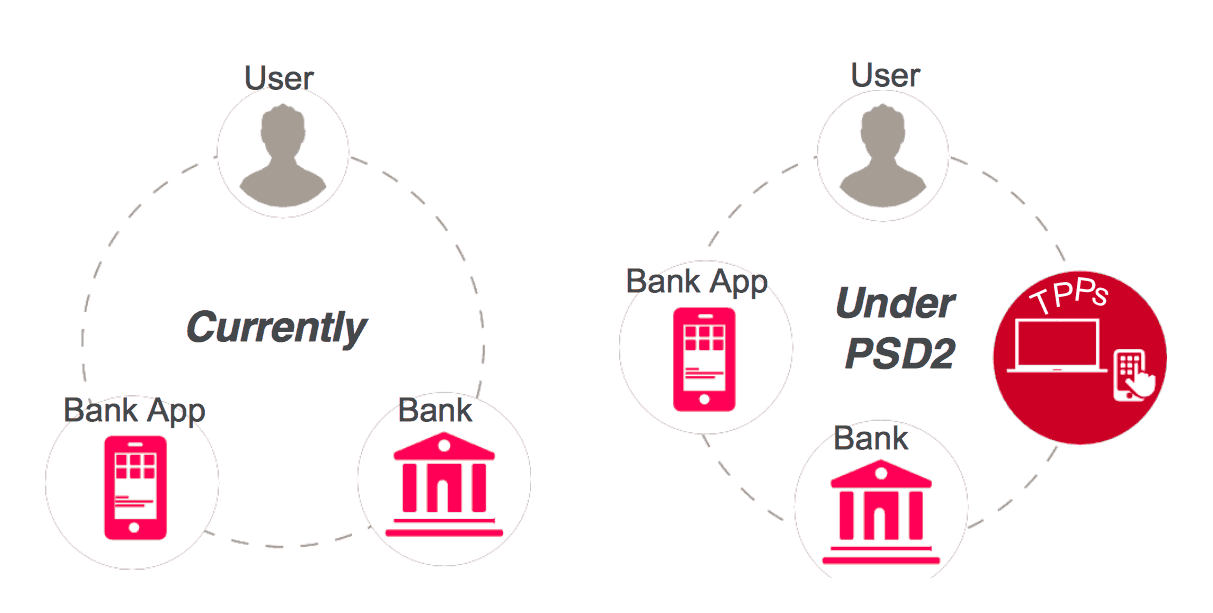

The most significant change proposed by the game changing PSD2 is the use of Third Party Providers (TPP), of which there are two new types: Payment Initiation Service Providers (PISPs) and Account Information Service Providers (AISPs). Industry reports highlight that PISPs, will encourage competition in European payments market, as the payer, rather than initiating the payment directly with their bank, carries out the transaction via the PISP, which then passes the instruction to the bank. With AISPs, providers act as aggregators of customer payment account information. Some key changes enforced by PSD2 are; new security and authentication requirements and an extension to the scope of transactions captured under the directive. The most significant new security requirement for payment transactions is to be subject to strong customer authentication. In addition, PSD2 includes in its scope ‘one leg out’ transactions, i.e., payments made to or from locations outside Europe.

Payment Industry describes, that goals of PSD2 are to make payments more secure, cheaper and safer, as well as to create a more integrated and efficient European payments market and level the playing field for payment service providers (PSPs). The first payment services directive, PSD1, came into force in 2007 and was transposed into national legislation by all EU and European Economic Area (EEA) member states in 2009. PSD1 was designed to increase pan-European competition and participation in the payments industry It also provided a level playing field by harmonizing consumer protection and the rights and obligations of payment providers and users. PSD2 goes further in legalizing and opening up the market for new players to challenge incumbent banks, stimulate innovation, competition and create an integrated and efficient market. Aiding the professionals in the payment industry to learn more about this game changing PSD2, GLC Europe is organizing an event in Vienna on 14th & 15th September 2017. Many experts in the Payments industry will debate the future of Europe’s Payments Industry at this event titled ‘InnoPay 2017’. The comprehensive two-day conference will feature expert speakers from leading organizations and delegates will also have access to interact with peers and understand the latest trends in the industry.