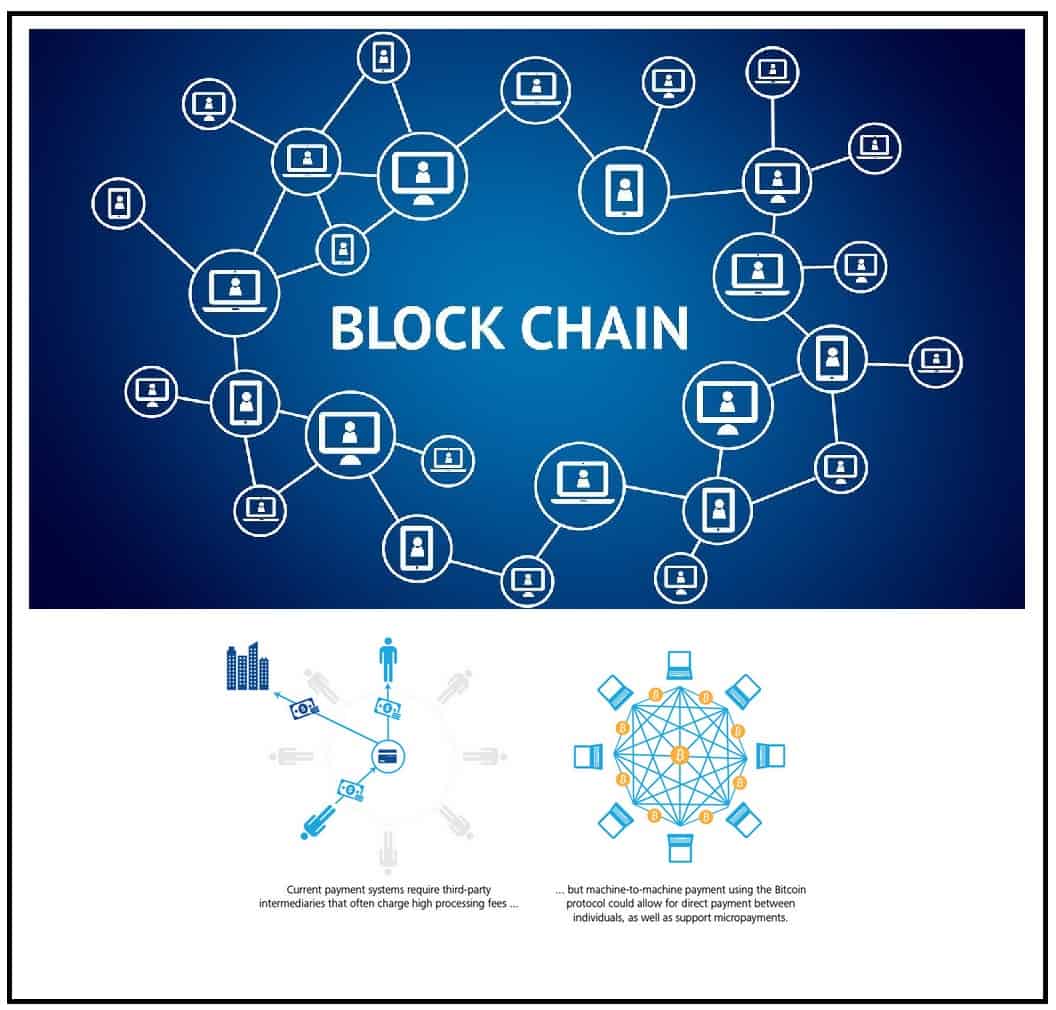

One of the most expensive asset classes and expensive digital assets in the World right now is Bitcoin. The rise of Bitcoin in payment industry was fueled by the ability to make transactions in a very cheap, fast, and reliable manner. What initially started as Bitcoin had expanded into a list of over 900 crypto-currencies so far. Every month at least one new crypto- currency is introduced to the world by blockchain developers cross the globe. By market capitalization, Bitcoin is currently the largest Blockchain network, followed by Ethereum, Ripple and Litecoin. Bitcoin and all other Crypto Currencies are simple applications that are leveraging the Blockchain Technology to send money around.

Millennial and all the other generations are slowly and steadily starting to invest in this new Digital Asset Classes, adopting the Blockchain Technology to make their day to day payments. The World has evolved from Bitcoins to BitLoans and talks are underway to form Bitcoin Exchange Traded Funds. Two decades ago, Central bankers were discussing countries around the globe switching themselves to regional currencies like Euro, Rupee, etc.. and probable use of a ‘One Global Currency’ in future. But now they are in the opinion that every country may have their own Digital Currency in future. As a result, financial industry giants in payments processing industry are converting and adopting themselves to new emerging delivery approaches for instant payment processing such as Blockchain Technology that incorporates real-time fraud prevention methods. From 14th & 15th September, GLC Europe will be hosting ‘InnoPay 2017’- the 4th Annual European Payments Forum in Vienna which will provide an opportunity for participants to understand and adopt the latest Blockchain Technological developments in future payment systems.

Faster unit cost rise of Bitcoin from US $ 600 levels to the US $ 3,000 in June 2016 to June 2017 period and subsequent increase of Ethereum, LiteCoin and other crypto-currencies are what paved the way for worldwide interest in Blockchain. The technology that made micropayments practical is Blockchain. Now many financial institutions have seen the potential and have begun researching on it. Sooner the World will witness all financial transactions, from paychecks to derivative contracts residing on a public distributed ledger. Thus everyone, including regulators, would be in a much better position to see dangers they may have to face whilst processing the payments. If a major bank runs into a trouble, regulatory authorities wouldn’t have to worry about the impact on vital payment or ledger systems. In future, the Internet of Things will need Blockchains to manage ultimately trillions of daily transactions. Blockchain technologies will beat traditional financial services companies that cannot manage micropayments and settle payments. The event ‘InnoPay 2017’ will bring in industry experts to create value through Platforms, People and Technology.